For a while, the TV commercials were seemingly ubiquitous: a variety of working professionals and business owners, walking around their offices or homes with giant 6-figure or 7-figure numbers trailing behind them like overly dependent puppies. The numbers, of course, were meant to represent the workers’ “retirement numbers”, the amount of money that those individuals needed in order to support their (or their families’) financial needs during their retirement years. The implication, of course, was that retirement savings had a “finish line” of sorts, and that once that number was met, all was well.

That interpretation is, however, an oversimplification. How much money is needed for retirement can vary based on a number of interrelated factors, some knowable, some unknowable. That’s why even though the advertisements were both memorable and somewhat effective, still relatively few prospective retirees have any real concept of what “their number” actually is, or whether they’re on target to meet that savings goal.

Financial advisors and other industry experts have since attempted to generate a few easily digestable rule-of-thumb guidelines to assist people with their planning, and those efforts have had mixed success. For people who have “typical” financial pictures (average retirement age, average lifestyle expenses), the rules of thumb can be quite helpful. But with dozens of variables at play in the retirement savings equation, not everyone can so easily be placed into an “average” box. While retirement age and income/expense level are always the major drivers of how large a retirement account balance needs to grow, secondary factors like investment risk tolerance, health-related factors, and tax considerations can have significant impacts as well. We’ll summarize a few of the major considerations in play, with the hopes of adding some simplicity and clarity to the retirement savings puzzle.

The expense-multiple approach

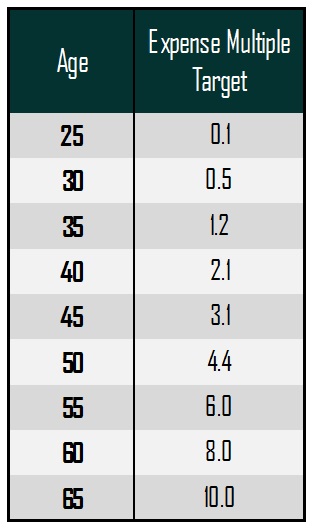

One of the most commonly cited industry rules of thumb attempts to place a simple multiplier factor on a retiree’s expected annual expenses in retirement, with 10 times annual expenses standing as a common target for an age-65 retiree with average lifestyle expenses. In meetings with clients, we’ll often refer to this ratio as the “Capital-to-Expense Ratio (CER)”, and we’ll track it over time as a basic guidepost on the path toward retirement.

In addition to the “10 times expenses” target, we’ll also often show younger workers a “glide path” with intermediate targets at 5-year increments: a CER of 2.1 by age 40, for example, or 6.0 by age 55. As long as a younger worker is in line with—or ahead of—these intermediate targets, he or she can have a reasonable expectation of meeting the age-65 goal, assuming that 10-15% of gross income continues to be saved into retirement accounts in the interim years.

It is important to note that the 10.0 CER target does take into account an assumption of at least some income from Social Security, so that the retirement account savings don’t have to do all of the heavy lifting. Without that income, the target ratio at age 65 would certainly be higher.

The major driving factors

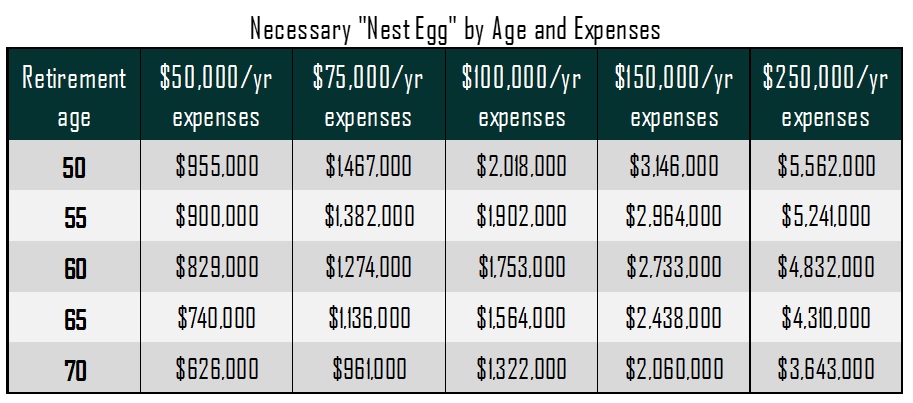

While the CER of 10.0 is a reasonable average target for a typical retiree, there are a number of factors that will impact whether an individual’s personal CER is higher or lower than that standard rule of thumb. Naturally, the two most significant drivers of the target CER are the factors that actually determine future financial needs: retirement age and annual expenses—the more money you spend per year, or the more years of retirement that you need to save for, the higher your CER will need to be at your desired retirement age.

For someone who wants to retire at age 55, for example, the target CER will likely be anywhere between 18 and 20, depending on the level of annual expenses. And even for two people planning to retire at the “standard” age of 65, the necessary multiple can be several points higher than the recommended 10, if the overall level of expenses are higher. This is primarily due to the fact that higher retirement account withdrawals will generate higher taxes, so the “tax drag” on retirement withdrawals is higher for those with higher expenses/incomes, and more needs to be saved in order to cover that increased tax burden. For those individuals who don’t think they can meet the higher multiples that their projected expenses require, some reconsideration of retirement-year expenses may be necessary: moving to an area with a lower cost of living, for example, or thinking twice about travel and other discretionary expenses.

The minor driving factors

Besides the two primary determinants of retirement age and annual expenses, some other considerations can often come into play, as well. These secondary considerations can include investment risk tolerance, health-related factors, other income sources (pensions, business ownership interests, or part-time work), or even certain tax-related impacts.

Most industry CER targets assume an annual investment return on retirement assets of at least 5 to 6%; for an individual with a particularly risk-averse investment approach, this might be an unrealistic target, and the target CER would be higher as a result. Health factors, meanwhile, can cut both ways: an individual with known health problems might have a lower life expectancy (and therefore, fewer years of expenses, and a lower CER target), but those years might also have above-average medical expenses associated with them, driving the target CER higher.

Finally, taxes always need to be considered, since the types of accounts that were used to save for retirement can significantly alter how much needs to be withdrawn annually in order to meet expenses. A saver with a high balance in a Roth IRA, for example, will owe little or nothing in taxes in retirement, and fewer investment dollars will be needed as a result. Understanding how and when to withdraw from a Roth IRA, a Traditional IRA, or a taxable investment account can be complicated, and the expertise of an experienced professional can be vital. And while the CER is a useful tool, it is just a small part of a broader retirement plan, and should be considered only as a guide, not a panacea. Comprehensive retirement planning is a complicated, decades-long process, and we at Cypress are always prepared to help.