As the nation prepares to inaugurate a new president with strongly different viewpoints and policy prescriptions than those who have preceded him, a number of financial rules and regulations have found themselves suddenly on the chopping block. President-elect Trump and potential members of his administration have already openly challenged last year’s Department of Labor fiduciary rule, and challenges to the estate tax and other progressive taxes seem destined for renewed debate, if not outright repeal.

Amid all the sound and fury, one potential change to our tax code (and our retirement plans) has gone relatively unnoticed, but it ultimately may have significant implications. The change pertains to the so-called “stretch IRA”, a savings withdrawal method that has long provided a tax-deferral boon to those who have been fortunate enough to inherit 401(k) or IRA assets from deceased loved ones.

While legal challenges to the stretch IRA have been common in recent years, previous efforts have mostly withered on the vine awaiting congressional approval. Buoyed by the potential revenue-raising implications of a repeal, though, the Senate Finance Committee voted 26-0 in September to recommend a proposed bill that would kill the stretch IRA, albeit with some caveats. The Senate proposal was subsequently included in a bill named the “Retirement Enhancement and Savings Act”, and a vote on the measure could come early in 2017.

So, what is the “stretch IRA”, and why does it matter to you? Should the bill cause you to take a second look at the beneficiary designations on your existing retirement accounts (or, perhaps, should you be doing that already)? We’ll take a quick look at the basics of beneficiary designations, to help you better understand whom to name, and why.

Why beneficiaries matter

One of the main functions of any well-considered estate plan is to ensure a smooth and expeditious distribution of assets upon one’s death. Retirement accounts like 401(k) plans and IRAs are particularly convenient in this regard, since essentially all of them allow the account owner to designate a number of different beneficiaries (both primary and contingent) to whom the assets are required to pass upon the owner’s death. A potentially long and costly probate process can be avoided, and legal challenges to beneficiary designations are essentially non-existent.

Beneficiary designations are therefore extremely powerful—not only do they allow assets to automatically avoid probate, they also override any other stipulations made in a will, trust, or other estate planning document. If your beneficiary designations are at odds with your broader wishes, then your will may end up becoming little more than a trivial piece of paper.

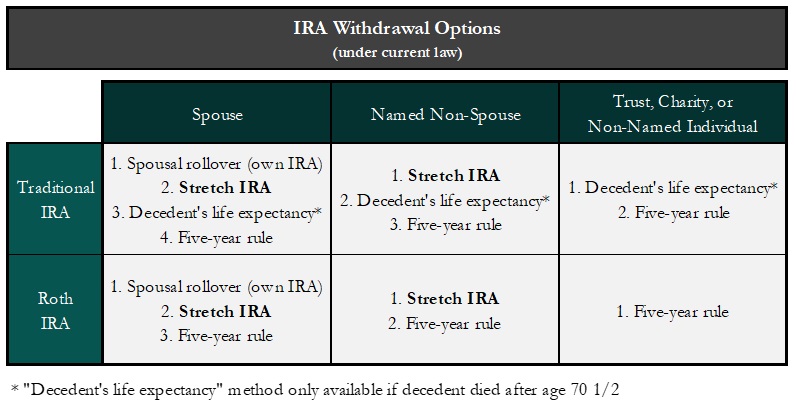

For married individuals, an account owner should usually name his or her spouse as the primary beneficiary—spouses have the most flexibility with how to treat inherited retirement accounts, and in many cases (and many states), account owners are required to obtain spousal consent if they wish to name anybody but their spouse as primary beneficiary. That doesn’t mean, though, that beneficiary designations should ever be ignored or left up to the courts (or “default” options). Distribution options are always maximized when there is a specific, named beneficiary listed on an account—it’s therefore important not only to explicitly list a primary beneficiary, but also to name specific contingent beneficiaries, as well.

Source: IRS

The primary benefit of being a “named non-spouse” beneficiary (whether primary or contingent) is the availability of the “stretch IRA”. Under the stretch IRA provision, if a named beneficiary properly opens and funds an “inherited IRA”, the beneficiary will be eligible to withdraw account funds gradually over time, in accordance with their own life expectancy. For younger beneficiaries who may have several decades of life expectancy remaining (according to the IRS’ “Single Life Expectancy” table), this provision allows them to “stretch” the tax-deferral benefit over a long time period, thus maximizing the tax benefits that accrue to them as beneficiaries.

However, if a 401(k) or IRA account has no named beneficiaries (or if all named beneficiaries are already deceased, or if the named beneficiary is a charity or a trust), then the stretch IRA option is automatically eliminated. Whoever does ultimately receive the assets will generally default to the so-called “five-year rule”, in which all account assets are required to be distributed within five years of the original account owner’s death. Given the potentially sizable benefits of stretching the tax-deferral benefit, this outcome both can and should be avoided.

Implications of the proposed bill

The large tax-deferral benefits of the stretch provision are also the reason for its proposed repeal. While the exact figures remain the subject of debate, members of the Senate Finance Committee estimate a positive budgetary impact of $5.5 billion over a 10-year period. That’s not a huge deal in the context of a $3.8 trillion annual federal budget, but it’s enough to spark congressional attention, so here we are.

Even if the stretch provision is repealed, however, it’s important to note that the impact will be limited. Spousal beneficiaries will still have the option of rolling an inherited IRA into their own IRA, enabling them to withdraw funds based on their own life expectancy. And because Roth IRA distributions are not taxed when they are withdrawn, Congress has no pressing reason to force Roth IRA beneficiaries to withdraw their funds on an accelerated basis—Roth accounts are therefore expected to be left alone by any future repeal of the stretch IRA provision. Certain dollar-amount exclusions may also be instated, but those details are not yet fully known.

In the event that the stretch IRA is in fact killed, IRA beneficiaries—particularly younger, prime-working-years beneficiaries—could find themselves pushed into the highest tax bracket as potentially large, six-figure IRA distributions are added to their other sources of income. One strategy that retirees with large IRA balances might consider is a system of aggressive Roth IRA conversions—especially if spread over a number of years, these conversions can occur at lower tax rates than the high rates that beneficiaries would eventually face, thus saving on total lifetime tax bills. With the future of the stretch provision in doubt, it’s now more important than ever to understand the implications of our beneficiary designations, and the tax impacts that inheritances may have on our heirs. Thoughtful strategies on the front end can yield benefits for multiple generations.

Information found in this blog post is not intended to be individualized tax advice or legal advice. Please discuss such issues with a qualified tax advisor.