As a new year dawns, many of us are taking a fresh look at our household budgets, determining where and how we plan to save money over the next twelve months. During that process, we’ll inevitably face tradeoffs between various financial goals—should we pay down debt, or build up our emergency fund? Is it better to refinance our mortgage to a shorter term (and higher monthly payment), or keep flexibility within our budget to cover unexpected expenses?

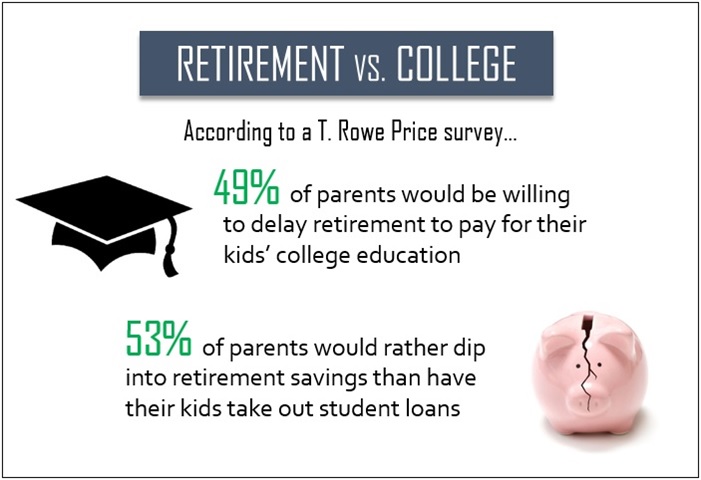

But of all the various tradeoffs we face, one of the most difficult—especially for those of us with young children or grandchildren—is whether to save for retirement or for future college expenses. As parents, we generally want to do everything we can to secure a better future for our children, and with college tuition costs continuing to soar, it’s a natural desire to want to help cover those costs. After all, we don’t want to leave our kids saddled with mountains of student loan debt, forcing them to face their own difficult decisions about which jobs to take, and when (or if) to get married or have children or buy a house.

So, does it make sense to prioritize college savings ahead of retirement savings? Which one should be secured first, or can both goals be met simultaneously? In the following paragraphs, we’ll provide a quick summary of the major considerations.

“Skin in the game”

The first step in solving the dilemma is determining whether or not it is, in fact, a good thing for parents to help cover tuition expenses in the first place. On its surface, that doesn’t seem like much of a question at all—of course parents should try to help, why shouldn’t they? But some recent research would disagree.

A widely-cited study conducted by University of California-Merced professor Laura Hamilton found that the more parents contributed to their children’s college costs, the worse those students’ academic performance became. In other words, if the students had little or no financial “skin in the game,” they tended not to take their studies seriously, and they focused instead on some of college’s more “social” aspects.

For children whose parents were more affluent, the long-term impact on career outcomes was muted, presumably because the parents’ other connections and relationships were strong enough to overcome their kids’ subpar academic performance, helping them to earn jobs they may not otherwise have been able to land. But for the kids from lower-income or middle-income families—those families whose financial sacrifices to help with tuition were likely the most acute—the academic underperformance had significant long-term consequences. That’s a particularly ironic side effect of an otherwise well-intentioned parenting decision.

So, if it’s advisable for our kids to pay at least a portion of their college tuition, but we don’t want them emerging with a degree and an anchor of debt, what’s the best answer?

In general, it’s best to involve them in the financial conversation early. Don’t just tell your kids to pick out their dream school, with cost being no object—encourage them to think about their college choice in its totality, including the costs and the expected “value” received. The sooner they begin to personalize the financial impact of their college decision, the better it will be for all parties.

Maximizing flexibility

Regardless of the advisability of actually paying for our kids’ college tuition, there are also other considerations with respect to saving for it that must be evaluated. As a general rule, if there’s ever any question as to whether you should save for college or for retirement, retirement should be a slam-dunk winner every time. Here’s why:

There are no “retirement loans”

Student loans may come with a host of problems and stigmas, but they at least exist as a funding option for college. When it comes to paying for retirement, though, there is no such thing as a retirement loan—if you arrive at your retirement years (or deep into them) without enough assets to cover your expenses, there are few options available to you to make ends meet. One of the few tools available is a reverse mortgage, which comes with its own set of issues and drawbacks (also, you’ll need to own a home in order to even have it as an option, and not all retirees are homeowners).

Your kids can work during college

In addition to taking out loans, your kids can always choose to work during college (or college summers) in order to help pay for a portion of their tuition. While you can choose to work through retirement (assuming you’re still healthy enough to do so), a working retirement isn’t really a retirement, is it? You don’t want to work hard to put your kids through college and then find that you’re never able to retire as a result.

IRA savings can pull “double duty”

Perhaps the most compelling reason to prioritize retirement over college is the one we’ve saved for last: your retirement savings can ALSO serve as college savings! While there are certain rules and restrictions, you can generally make withdrawals from an IRA in order to pay for qualified college expenses—income tax will apply to those withdrawals, but early withdrawal penalties should not.

Furthermore, assets saved in Roth IRAs can pull an even more powerful daily double, since contributions (though generally not investment earnings) can typically be withdrawn without penalty and used for any purpose you choose. So, if you’ve saved for retirement in a Roth, you can withdraw the contributions to pay for college, leaving the portion representing “earnings” in the account to further accumulate until retirement.

Therefore, funds directed to IRAs can typically be used to save for both retirement and college tuition, something that is rarely true about 529s or other college savings vehicles. That flexibility and freedom of choice makes the decision between saving for retirement or college an easy one; save for retirement, and you could kill two birds with one stone.

If, of course, you’ve already exhausted your tax-deferred retirement account options (including maxing out your Roth IRA), or if you’re simply already on target to save more than enough to cover your retirement expenses, then saving money for college could absolutely be a viable option. At Cypress, our comprehensive planning approach and long-term projections can help you determine whether you’re saving enough for retirement, and whether saving for college might actually be a good idea. But if in doubt, satisfy the retirement goal first, since there are many more ways to pay for college than there are to pay for retirement.

The views expressed are not intended as a forecast, a guarantee of future results, an investment recommendation, or an offer to buy or sell any securities. The information provided is general and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person.